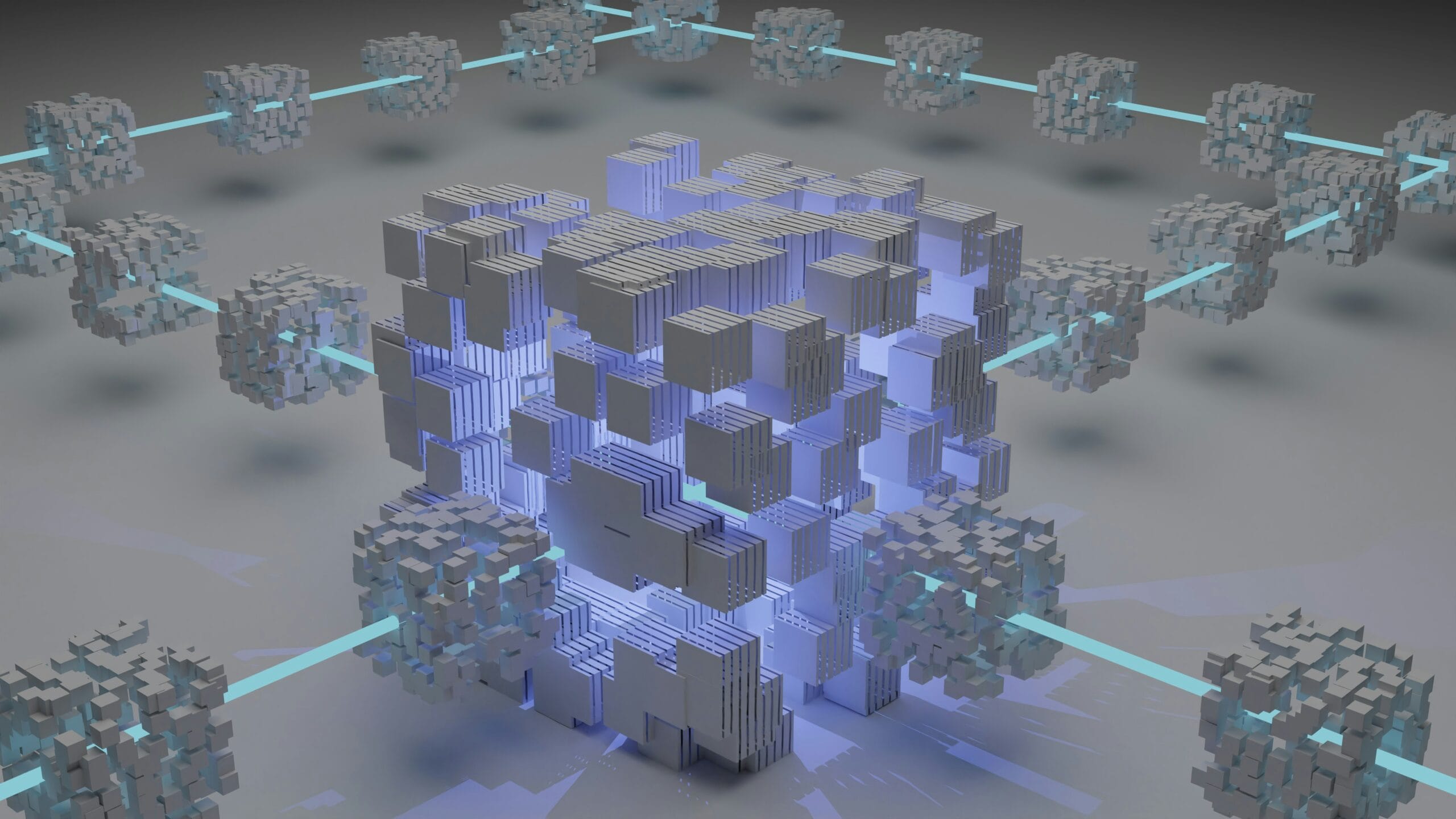

Blockchain technology is a decentralized digital ledger system that enables the secure recording of transactions across multiple computers. This innovative technology eliminates the need for a central authority, allowing for peer-to-peer interactions in various applications, notably in the domain of cryptocurrencies. The primary characteristics of blockchain include decentralization, immutability, transparency, and security, which collectively set it apart from traditional financial systems.

Decentralization is a core principle of blockchain technology, as it disperses control among a network of nodes rather than concentrating it in a single entity. This distribution minimizes the risk of fraud or manipulation, which is often associated with centralized systems. Each transaction is recorded on a public ledger that is accessible to all network participants, promoting transparency. This openness not only builds trust among users but also facilitates auditing processes, as anyone can review the transaction history.

Immutability is another significant feature of blockchain. Once a transaction is entered into the blockchain, it cannot be altered retroactively without the consensus of the network. This characteristic ensures the integrity of historical transaction data, providing a robust solution for maintaining accurate records. Additionally, the use of cryptography enhances the security of the blockchain, as it ensures only authorized parties can access and validate transactions.

There are several types of blockchain networks, including public, private, and consortium blockchains. Public blockchains, like Bitcoin, allow anyone to participate in the network and validate transactions. Private blockchains, on the other hand, restrict access, making them ideal for businesses that require confidentiality without sacrificing the benefits of the technology. Consortium blockchains sit between these two extremes, where multiple organizations share control over the network. These different types of blockchains have diverse applications, from supply chain management to secure voting systems, illustrating the versatility of blockchain beyond the realm of cryptocurrencies.

The Rise of Cryptocurrencies

The inception of Bitcoin in 2009 marked the beginning of a significant transformation in the financial landscape, giving birth to the phenomenon known as cryptocurrencies. It was the first decentralized currency to utilize blockchain technology, establishing a unique paradigm in which financial transactions occur without the need for centralized authorities such as banks. Bitcoin’s efficient and transparent structure quickly garnered attention, paving the way for a myriad of alternative cryptocurrencies, often referred to as altcoins, such as Ethereum, Ripple, and Litecoin, each introducing unique functionalities and improvements.

The rise of these digital currencies can be attributed to several compelling factors. One of the most prominent motivators is the increasing desire for financial autonomy. In an age where traditional banking systems are often viewed with skepticism, cryptocurrencies offer individuals greater control over their monetary transactions, enabling peer-to-peer exchanges that circumvent intermediaries. This autonomy resonates particularly well in regions with unstable currencies or limited access to banking services, where people can adopt cryptocurrencies as a viable means of preserving value and facilitating transactions.

Moreover, the allure of investment opportunities has significantly fueled the cryptocurrency market’s popularity. As prices for various cryptocurrencies have surged, investors are drawn to the potential for substantial returns. This interest has sparked a rush of new participants, ultimately leading to the creation of diverse investment instruments such as cryptocurrency funds and derivatives, further embedding digital currencies into mainstream finance.

Furthermore, cryptocurrencies have begun to play a pivotal role in enhancing financial inclusion worldwide. By leveraging blockchain technology, individuals in underserved areas can access financial services previously unavailable to them. This innovative ecosystem facilitates remittances, microloans, and decentralized finance solutions, promoting economic participation and empowerment. The emergence of cryptocurrencies signifies not just a technological advancement but also a chance to redefine financial structures for myriad global users.

Implications for the Financial Industry

The emergence of blockchain technology and cryptocurrencies marks a pivotal trend that has the potential to disrupt the traditional financial industry fundamentally. Blockchain serves as a decentralized ledger that ensures transparency and security in transactions, while cryptocurrencies offer an alternative to conventional currency systems. This transformative shift poses significant implications for banking, payment systems, and asset management practices.

In banking, blockchain can streamline operations by enhancing efficiency in transaction processing and enabling around-the-clock accessibility. The traditional model, characterized by intermediaries and extensive paperwork, is challenged by the seamless nature of peer-to-peer transactions facilitated by cryptocurrencies. As a result, banks may have to reconsider their roles, moving towards providing more value-added services rather than acting solely as intermediaries.

Furthermore, payment systems are experiencing a paradigm shift as digital currencies gain acceptance in the mainstream. Cryptocurrencies, with their ability to facilitate instant cross-border transactions devoid of hefty fees and delays, signal a change in how individuals and businesses approach international trade. This technology could lead to reduced reliance on credit cards and traditional banking infrastructures, ushering in more cost-effective and immediate payment solutions.

Asset management is also being revolutionized as blockchain enables the tokenization of various assets, allowing for fractional ownership and increased liquidity. This could democratize access to investment opportunities, traditionally reserved for affluent investors. However, the rise of digital currencies and decentralized finance (DeFi) presents regulatory challenges, as governments and financial institutions grapple with jurisdictional issues, tax implications, and consumer protection. The evolving landscape requires a responsive regulatory framework that can balance innovation with risk management.

As financial institutions look toward the future, navigating the implications of blockchain and cryptocurrencies will be critical. Embracing these innovations could result in novel business models and greater client satisfaction; however, they must also remain vigilant about the regulatory landscape that continues to evolve alongside this new financial revolution.

The Future of Finance: Opportunities and Challenges

The landscape of finance is undergoing a transformative shift as blockchain technology and cryptocurrencies pave the way for what many are calling a new financial revolution. The potential opportunities presented by these innovations are vast. For instance, blockchain’s decentralized nature can facilitate more efficient financial transactions, reducing the need for intermediaries and lowering costs for consumers. This disruption is not limited to conventional banking systems; it extends to various sectors, including remittances, payments, and even contract management, where smart contracts operate automatically based on the fulfillment of predefined criteria.

Moreover, cryptocurrencies offer unprecedented access to financial services for the unbanked populations across the globe. By leveraging mobile devices and blockchain infrastructure, individuals who previously had no access to conventional banking systems can now participate in the global economy. This access could potentially lead to significant economic growth and innovation, fostering inclusivity in financial systems that have long been dominated by a select few. Blockchain technology also provides transparency and security, qualities that could help to restore trust in financial institutions that have faced scrutiny in recent years.

However, this optimistic outlook is tempered by significant challenges that must be addressed. Regulatory uncertainties remain a prominent issue, as governments worldwide struggle to develop frameworks that can accommodate this rapidly evolving technology without stifling innovation. Additionally, the volatility of cryptocurrencies presents a substantial barrier for widespread adoption, as price fluctuations can deter everyday users. Technological challenges, such as overwhelming energy consumption associated with some blockchain protocols, also pose obstacles to scalability and sustainability.

As we explore whether we are indeed witnessing a new financial revolution or simply a trend within the existing financial ecosystem, it becomes apparent that the trajectory of blockchain and cryptocurrencies is critical. The outcome will likely depend on stakeholders’ ability to harness the opportunities while effectively addressing the inherent challenges.